As we begin Governance Period 7, we take a look at DeFi Rewards implementation data from previous periods and disclose the details of the first Targeted DeFi Rewards distribution plan.

Preamble: Governance Rewards and DeFi

In Governance Period #4, which took place June 30 - September 30, 2022, governors approved a measure to allocate 7 million ALGOs as extra incentives to governors who are also Algorand DeFi users, alongside another measure to allow DEX liquidity providers to participate in governance. It was the first time governance rewards were allocated to activities outside of the Algorand Foundation Governance. The idea behind this was to increase DeFi participation and use of ALGO, which would, in turn, benefit all governors.

It worked. After this measure was implemented, we saw a dramatic increase in the number of governors participating in DeFI. This was made clear to us when we looked at the total value locked (TVL) in the Algorand ecosystem on DefiLlama alongside our governance period start dates. There was an increase in TVL at the start of each governance period, as can be noted by looking at the graph below. The blue and the red line represent respectively the total value locked in the Algorand ecosystem. The blue includes all of the available options from DefiLlama, while the red excludes them (for explicit definition of the available options, visit DefiLlama website). In both cases, the net impact of the governance is clearly visible at every starting point.

The TVL growth was significant and the Algorand community noticed, responding with enthusiasm and positive feedback. This led us to propose increasing the DeFi rewards for governors again in Governance Period #5 (September 30 - December 31, 2022) from 7 million to 15 million ALGOs. The response was overwhelmingly positive and the measure was approved.

In a bid to further support our DeFi ecosystem through the crypto bear market, we proposed increasing the total DeFi rewards by a further 5 million in Governance Period #6 (Dec 31, 2022 - March 31, 2023), bringing the incentives total to 20 million ALGOs. This time there was a twist: governors could choose to have the 5 million ALGOs distributed directly to DeFi projects within a certain criteria.

The objective is to attract new users to our DeFi protocols who may be ready to explore the Algorand DeFi ecosystem but not yet be ready to commit to 3-month governance participation. This measure received an overwhelming approval rate of 89.6%. This kind of support really shows the community appetite for incentive programs that support the growth of our nascent DeFi ecosystem.

The Targeted DeFi Rewards Program

The goals of the program are to attract new DeFi users and increase flexibility in the governance rewards system. While at times the governance structure may feel rigid, the implementation of targeted DeFi rewards aims to counter that. It gives DeFi projects more flexibility to structure and distribute these rewards to their user base, target rapid growth, deepen DEX liquidity, and provide incentives for DeFi users who are not participating in governance. At the same time, the constraints of distributing the rewards exclusively to the users ensures a fair deployment of the resources allocated through governance.

Eligibility Criteria

In order to apply to this program, projects had to have at least 500K ALGO equivalent in TVL of white-listed assets, including ALGO, as calculated on March 15, 2023.

The DeFi Advisory Committee reviewed all applications to verify each TVL claim, thus ensuring that claims were valid prior to approval. In addition, the applicant projects have committed to publish their respective calculations on a dedicated page, which will allow for further community oversight.

Assets Selection for TVL Calculation

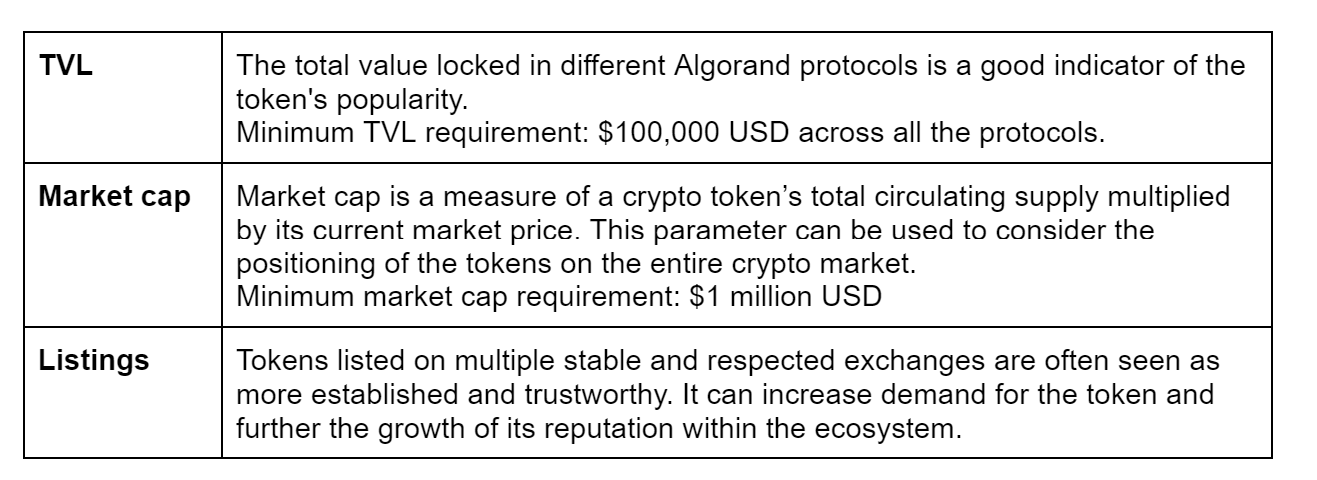

The metrics used to select eligible assets for rewards were carefully chosen to ensure they have a strong reputation, are difficult to manipulate, and are valuable to the ecosystem. This reputation comprises a combination of factors, including TVL, market map, and exchange listings. Assets are expected to meet at least two of the three criteria below to be included in the white-list.

Listings

The current applicable list of assets for targeted DeFi rewards TVL calculation is:

- ALGO

- gALGO - ASA ID 793124631

- USDC - ASA ID 31566704

- USDT - ASA ID 312769

- STBL2 - ASA ID 841126810

- goBTC - ASA ID 386192725

- goETH - ASA ID 386195940

- PLANETS - ASA ID 27165954

- GARD - ASA ID 684649988

- OPUL - ASA ID 287867876

- VESTIGE - ASA ID 700965019

- CHIPS - ASA ID 388592191

- DEFLY - ASA ID 470842789

- BANK - ASA ID 900652777

We received also the following applications, which were not accepted during the current period:

- VoteCoin - ASA ID 452399768

- goUSD - ASA ID 672913181

- DayByDay - ASA ID 747635241

The reason for the rejection is the current lack of liquidity as of March 15, 2023, but this motivation does not exclude future inclusion in the white-list, once sufficient liquidity has been reached.

Rewards Distribution

The first batch of rewards under this program will be distributed to projects at the beginning of Governance Period #7 and the projects must distribute the totality of the amount received as incentives to their users, with at least 95% of rewards initially distributed by the end of the period and the remainder distributed in the following period.

The projects will publish how they will distribute the rewards and provide a report at the end of the distribution, detailing how the rewards were allocated.

Rewards Calculation

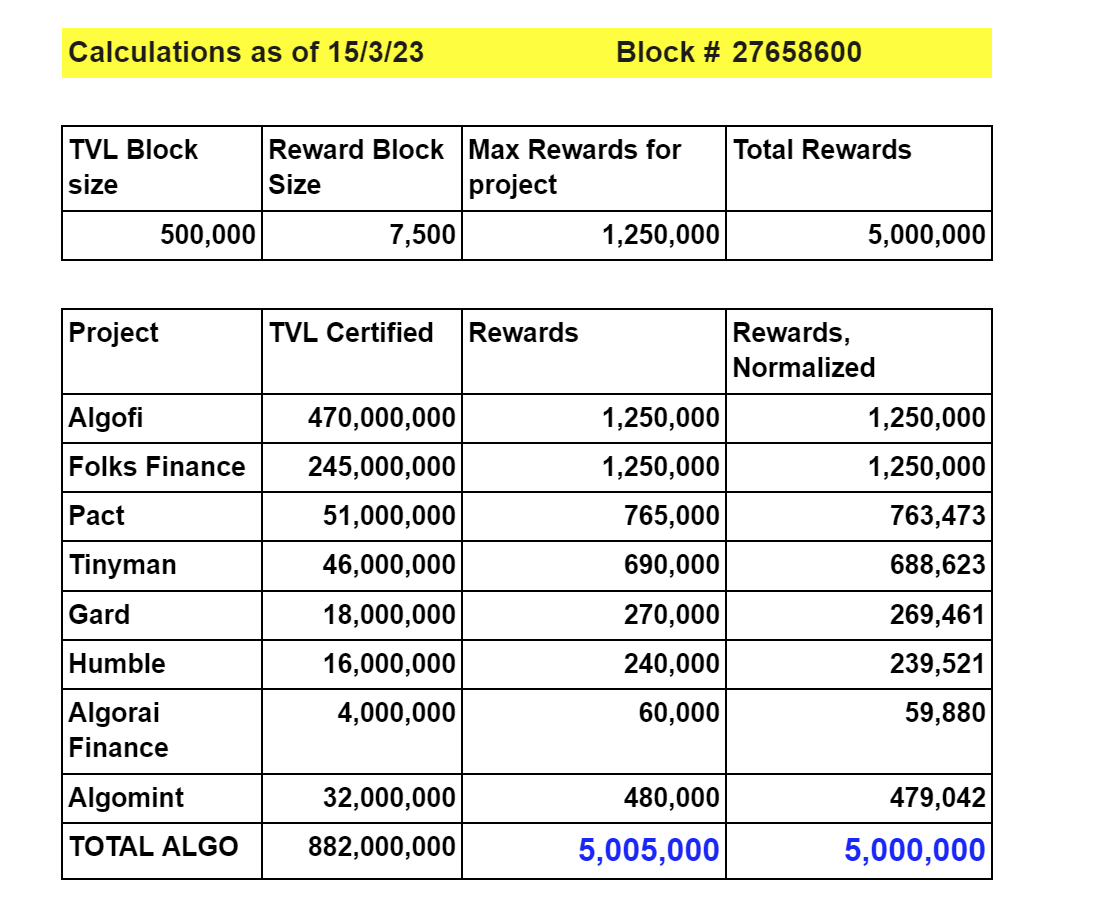

Projects will receive 7,500 ALGO for each 500,000 ALGO of “certified” TVL as defined above and rounded down. The calculation takes as input the balances at block height 27658600 (March 15, 2023). Moreover, rewards per project are capped at 25% of the total rewards distributed under this program for that period.

During this Governance Period #7, Algofi and Folks Finance theoretically exceeded the 25% of the total rewards, therefore their share has been capped at 1.25 million ALGO. Furthermore, since the totality of the rewards that in principle should have been distributed exceeds, even by a small amount, the maximum allocated Rewards of 5 million ALGO, every project’s rewards have been slightly normalized in order to reach the final total distribution of 5 million. The calculations are summarized here below in detail for every eligible project which has applied.

A list of the deposits and their respective wallet addresses will be made available on our website, once payments are processed. Every project that receives an ALGO allocation under this program has the duty to fully disclose all the relevant information related to its distribution in a dedicated public page, in order to ensure proper community review.

View the Governance Period 6 Measures